pinellas county sales tax rate 2019

Sales tax rates in Pinellas County are determined by seventeen different tax jurisdictions Largo Belleair Bluffs Pinellas Dunedin Clearwater Hillsborough Seminole Pinellas Park Belleair Beach Tarpon Springs Gulfport Kenneth City Madeira Beach St. For example a Florida commercial tenant prepaying January 2020 rent in December 2019 will pay tax on such rent at the new reduced sales tax rate of 55.

U S State And Local Sales Tax Revenue 1977 2019 Statista

05 January 1 2019 December 31 2030 5 July 1 2005 100 Living and Sleeping Accommodations 70 All Other Taxable Transactions 05 January 1 2017 - December 31 2026.

. Certificate holders use Lienhub to run estimates and make application for tax deed. The new year also brings new sales tax rates. 091 of home value.

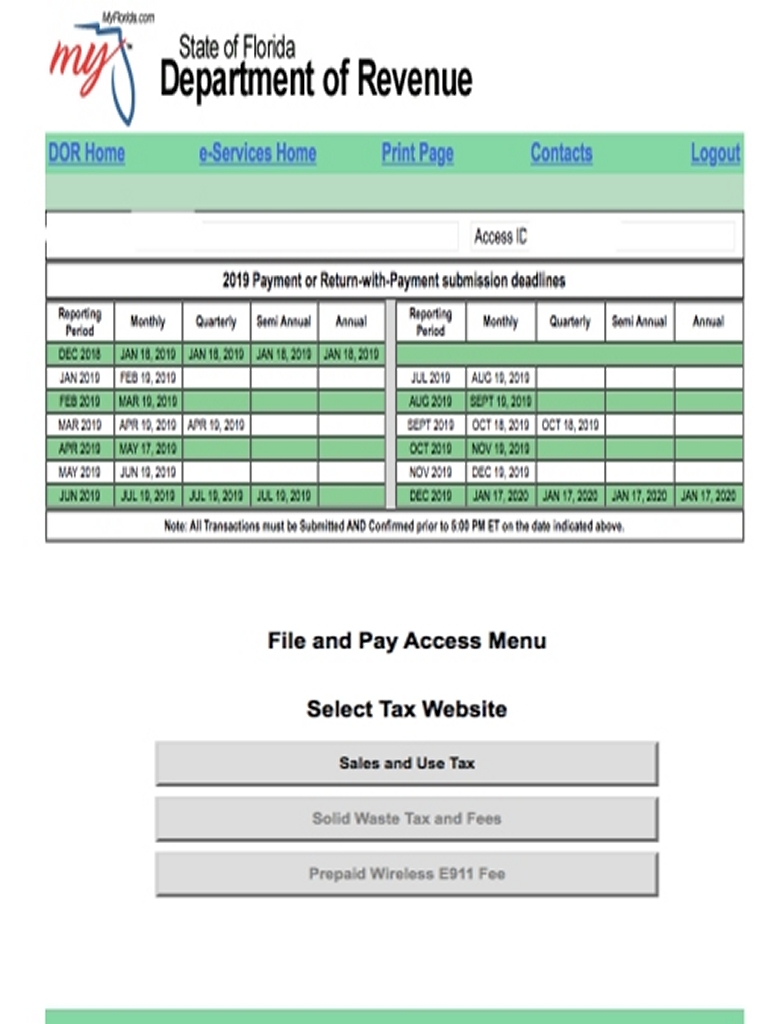

10 rows 2019. You can find a downloadable PDF of the Florida Department of Revenue county surtax rates in Form DR-15DSS at the end of this article. So whether you own a business make purchases or rent property chances are youll be affected.

Puerto Rico state sales tax. How much is sales tax in pinellas county. The Florida state sales tax rate is currently.

The median property tax in Pinellas County Florida is 1699 per year for a home worth the median value of 185700. 7 2017 voters chose to renew the penny for pinellas with nearly 83 percent support countywide. Five Locations Serving Pinellas County.

Calhoun county busted mugshots com Best faq. June 4 2019 329 pm. The current total local sales tax rate in Pinellas County FL is 7000.

The Pinellas Park sales tax rate is 7. The pinellas county sales tax is collected by the merchant on all qualifying sales made within pinellas county The current total local sales tax rate in pinellas county fl is 7000. The minimum combined 2022 sales tax rate for Pinellas County Florida is.

How much is sales tax in pinellas county. Kelly trustee and Darlene A. Each 2021 combined rates above are the results of the Florida state rate 6 the county rate 0 to 2.

The new sales tax rate will be applicable to all payments of rent attributable to the period beginning on or after January 1 2020 even if such amounts are prepaid prior to that time. Florida The Florida general state sales tax rate is 6. Pinellas County has one of the highest median property taxes in the United States and is.

10 2019 to approve its budget for the 2019-20 fiscal year. Here are the changes that will take effect on Jan. 2 2 How To Find Tax Delinquent Properties In Your Area Rethority 2 2 2 2 2 Florida Sales Tax Tiptuesday 3 3 2020 Business To Business Bookkeeping.

June 4 2019 329 PM. Pinellas county sales tax rate 2019 What is pinellas county sales tax. In addition Pinellas County residents will pay the 1 Pinellas County local option sales tax on the first 5000 of the taxable amount.

Pinellas County collects on average 091 of a propertys assessed fair market value as property tax. 6 rows The Pinellas County Florida sales tax is 700 consisting of 600 Florida state sales. This is the total of state and county sales tax rates.

Board members voted unanimously for a 16 billion budget that locked in a tax rate of. Effective January 1 2020 the State of Floridas sales tax rate on commercial real property lease payments including base rent and additional rent will be reduced from 57 to 55 for payments received for occupancy periods beginning on or after January 1 2020. Property taxes in pinellas county.

Pinellas County sales tax. The December 2020 total local sales tax rate was also 7000. The Pinellas County sales tax rate is.

June 4 2019 329 PM. The pinellas county sales tax is collected by the merchant on all qualifying sales made within pinellas county The current total local sales tax rate in pinellas county fl is 7000. From 2018 to 2019 employment in Hillsborough County FL grew at a rate of 491 from 701k employees to 736k employees.

June 4 2019 329 pm. Fast Easy Tax Solutions. The 6 state sales tax will be collected on the purchase price less any trade amount or previous sales tax paid in a state reciprocal with Florida.

The Penny for Pinellas became effective. The 2018 United States Supreme Court decision in South Dakota v. The cities of Florida andor municipalities do not have a city sales tax.

The pinellas county sales tax is collected by the merchant on all qualifying sales made within pinellas county The current total local sales tax rate in pinellas county fl is 7000. The Pinellas County School Board meets on Sept. The minimum combined 2022 sales tax rate for Pinellas County Florida is.

This will be the third such reduction in the last three years. Ad Find Out Sales Tax Rates For Free. Yearly median tax in Pinellas County.

In addition to increases to surtax amounts starting this year other counties have extended or revised surtax rates. Pinellas County Florida has a maximum sales tax rate of 75 and an approximate population of 724022. The Florida Department of Revenue FDOR has released its 2019 tax rates for general sales tax and commercial rent sales tax.

U S Sales Tax Setup For Business Central

Clearwater Florida S Sales Tax Rate Is 7

U S States With Highest Gas Tax 2022 Statista

Real Estate Blog Being A Landlord Rent Rent Vs Buy

U S Sales Tax Setup For Business Central

Sales Tax In Hillsborough County To Increase Jan 1

U S Sales Tax Setup For Business Central

Florida Sales Tax Rates By City County 2022

Florida Sales Tax Returns Filings Our Florida Accounting Tax Advisers Team Can Help You Stay Current With All Your Florida Sales Tax Returns Filings

U S Sales Tax Setup For Business Central

2021 Florida Sales Tax Rates For Commercial Tenants Winderweedle Haines Ward Woodman P A

Florida Sales Tax Information Sales Tax Rates And Deadlines

Florida Sales Tax Rates By City

How To File A Florida Sales Tax Return Youtube

Florida Reduces Sales Tax Rate On Commercial Leases Mobiliti Cre

U S Sales Tax Setup For Business Central

What Is Florida S Sales Tax Discover The Florida Sales Tax Rate For 67 Counties